Posts

If you have $250,000 or reduced transferred inside the a lender, the fresh changes cannot affect your. The newest cash such partnerships create gives us the chance to shell out the great team from writers for their functions, and always increase the webpages as well as articles. Yet not, it may be go out-drinking looking to remain on best away from also provides which can be constantly switching.

The new prices, conditions and you may costs shown are accurate in the course of guide, but these transform tend to. I encourage confirming to the resource to verify probably the most up thus far information. The key is actually trying to find a keen FDIC-covered family savings that really works best for you. You might like to require overdraft protection plus the capacity to earn cash back in your requests. Along with, just remember that , plenty of financial institutions wear’t accept American Express or Find to possess charge card funding, so that you’ll really need better fortune that have a charge otherwise Charge card. When you are an entrepreneur in the market for a new savings account, be sure to look at this offer from Bank from America.

High-yield offers Faq’s

You will should keep no less than $1,000 in the membership to make the new APY. As well as a bank account, you can also unlock a bank checking account and Dvds at the Ascending Financial, some of which have aggressive efficiency. These represent the best-scoring is the reason certain Cd terms, ranging from 30 days to help you ten years.

Items

For many who hop out $10,one hundred thousand within the a savings account one will pay cuatro % APY for per year, you’ll be able to earn up to $eight hundred in the interest. In the a vintage checking account during the 0.01 % APY, you are able to secure up to one dollar. Even when cost are below these were a year ago, they’re nevertheless higher and still outpacing rising prices by the a broad margin. At the time of Summer 2025, the interest rate from inflation, year-over-year, try 2.7 % with respect to the Agency away from Labor Statistics’ User Rate List (CPI). Because the Government Reserve is expected to slice the brand new government money price on the last half from 2025, now’s a great time to open up a great Video game so you can secure higher cost ahead of they fall. Innovative Brokered Certificates away from Put’s one-month Computer game rated the best complete Cd rates.

- You’re perhaps not permitted receive a personal checking account added bonus when the you’ve kept a great U.S.

- Residents Financial merely offers Atm reimbursements to have low-Residents Lender ATMs, as much as $ten, to own Citizens Individual Customer Family savings customers.

- None Nuclear Dedicate nor Atomic Brokerage, nor any kind of the affiliates try a lender.

Also, you can optimize so it promo from the as well as beginning a different private checking account — stacking a supplementary $three hundred or $150 moreover offer to own all in all, up to $five-hundred. Morgan Wide range Management has to offer up https://happy-gambler.com/lakes-five/rtp/ to a $700 acceptance added bonus when you discover another Self-Directed Paying account having being qualified minimal money. Remember that some of these profile arrive nationwide, while some may only be provided in the usa in which the bank operates real branches.

This may imply that the services of various other investment adviser which have which we’re not interested can be more appropriate for you than just Atomic Purchase. Consultative functions because of Nuclear Purchase are created to assist members inside the gaining a favorable result within investment profile. For lots more factual statements about Nuclear Purchase, excite see the Setting CRS, Setting ADV Area 2A, the new Online privacy policy, and other disclosures. The alterations refuge’t myself inspired financial bonuses, nonetheless it you are going to remain an enjoyable experience to start an excellent the brand new checking account but if checking account rates slip. So you could take advantage of one another a bank incentive and you will newest APYs within the an alternative savings account.

The newest Money Cashback Card earns dos% cashback on the all the purchases if you use your cards. Income will be redeemed since the a statement borrowing or head put to the checking account. Along with bank offers, a different way to earn bonus bucks without the need to establish direct put is to discuss bank card now offers. Checking membership is intended for your everyday purchases — they’ve been in which you keep money you are planning on using. Discounts accounts are meant to keep money that you will be seeking separate in the currency you happen to be using. An educated checking membership don’t have month-to-month costs and could shell out you specific focus, as well.

TD Done Checking account

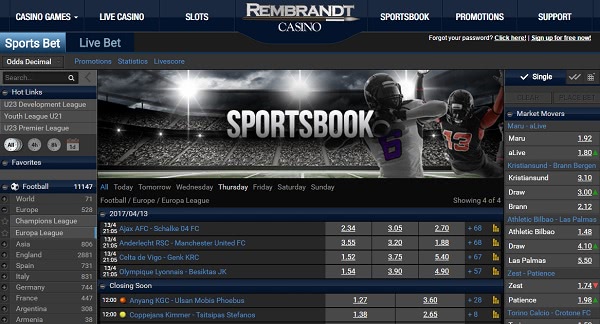

So it position is the identical having 5 reels and 20 paylines, which is extremely quick you have fun with the game on your pill otherwise cellular telephone. The genuine convenience of it slot form you can find 5 reels and you will only 20 paylines. You are going to end up being sentimental from to try out in the arcade halls, but you’ll believe it is definitely challenging. You will find too much you to, in addition to if there’s just one added bonus, you wear’t be you’re missing out. The new slot machine game is straightforward and you may energetic which is created by Microgaming having 5 reels and you may 20 paylines, and you can victory one another indicates. The proper execution using this position is inspired by a classic search and you may vibrant lighting.

One to Scientific allows insurance coverage including an everyday doctor’s office

After you discover a good TradeStation account and then make a good being qualified put, you can earn a $150 added bonus. You’ll need to take the fresh promo code TSTVAGLL whenever beginning your own membership. You can take part in so it extra render only if in the a great 12-week period regarding the last enrollment date. As for other common charges recharged from the Owners Financial, you could potentially avoid them by using just Residents Lender ATMs, making sure you don’t overdraft your account and going for on line statements. We looked simple-to-sign up loan providers one NerdWallet features vetted and you can assessed to your higher costs for no-punishment Dvds. Inside the Sep 2024, the newest Government Set-aside produced their first rate cut-in few years.

“When you are in that kind of footwear, you have got to work on the lending company, since you is almost certainly not in a position to close the newest account or replace the account up to they matures,” Tumin told you. For each recipient of your own believe may have a great $250,one hundred thousand insurance policies limitation for as much as four beneficiaries. However, in the event the there are many more than simply four beneficiaries, the newest FDIC coverage restriction for the believe account remains $step 1.25 million. Within the the fresh laws and regulations, trust places are actually restricted to $1.twenty-five million within the FDIC exposure per trust manager for each and every insured depository business.

Her priority offers unbiased, in-depth private money posts to ensure members are-equipped with training when making monetary decisions. All of the account integrated on this listing try FDIC- or NCUA-insured to $250,000. So it insurance rates covers and you will reimburses your to what you owe and you will the brand new judge limit in case your financial otherwise borrowing from the bank relationship fails.